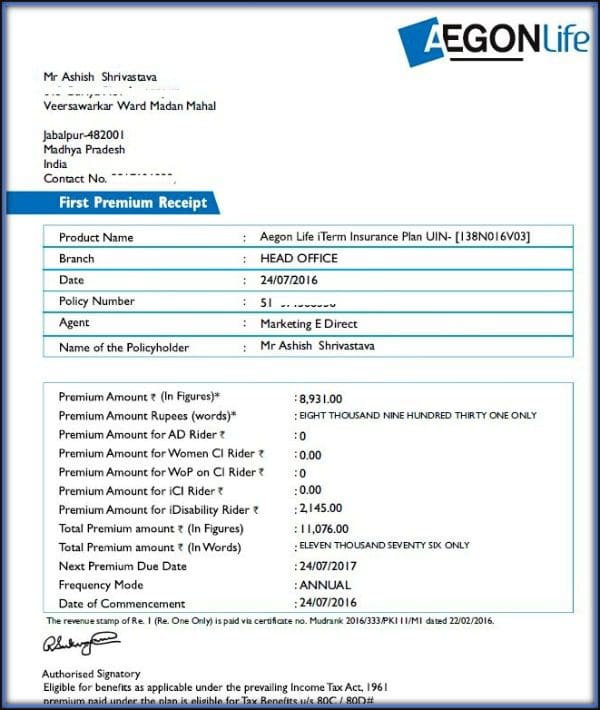

In case of single premium policy you may surrender the policy after completion of three policy years. Further, if the Life Assured under the policy, whether medically sane or insane, commits suicide, within one year of exercising the option to increase the Sum Assured, then the amount of increased Sum Assured will not be considered in the calculation of the Death Benefit In case of death by suicide during the first policy year, or within one year from the date of reinstatement, no death benefit is payable. Premiums paid for AEGON Religare Critical Illness Rider may qualify for deduction under Section 80D of the Income Tax Act, 1961. Section 80C, 10 (10D) of the Income Tax Act, 1961 would apply. On reinstatement, all outstanding premiums, without interest will be payable. If the Policyholder fails to reinstate a policy within this two year period from the premium due date, the policy will terminate. If premium are not paid before the expiry of the 30 day grace period from the premium due date, the policy will lapse. If a due premium is not received within the grace period of 30 days, your policy will lapse and the life insurance cover, including the rider cover, if any, will be terminated. You are allowed to pay premiums within 30 days from the due date. Upon such cancellation, you will be paid back the premiums, minus the cost of stamp duty, medical reports and proportionate premium for the period for which the risk was covered. In case, you are not satisfied, you may choose to cancel the policy within 15 days of receiving the policy documents. Half Yearly: 0.512 times annual premium Quarterly: 0.259 time annual premium Monthly (through ECS only): 0.087 time annual premiumĬover remains fixed for the tenure of the policy Premium Factor (multiply with annual premium) Single, Yearly, Half-yearly, Quarterly, Monthly (via ECS only) The benefit of low cost to insurance company is transferred to policyholders as low premium rates. The online policy helps saving costs, which otherwise would have to be paid to intermediaries. The rider to waive premium is valuable in this policy. The policy can be taken by anyone who can access the internet and make online payments.Ī term plan can be taken to cover against the irreversible loss of life of a breadwinner. This low cost policy is suitable for those looking for a high value cover.

Accidental Death rider does not cover accidental disability which is a more tough situation with no income and heavy medical expenses. The definition of terminal illness is not easy to understand and may lead to complications at the time of making a claim. The policy covers death due to terrorist attacks. It provides terminal illness benefit to policyholder. The policy is simple to purchase with lower premiums, especially for women. Females can opt for ‘women critical illness rider’ that covers illnesses pertaining to them such as complications at the time of pregnancy and malignant cancer of the female organs. The policy has the scope to enhance protection with three optional riders- accident death benefit, waiver of premium benefit on critical illnesses such as cancer, heart attack, bypass surgery and stroke. A policy with terminal illness rider will stop accepting future premiums on diagnosis and pay the illness benefit.

The balance will be paid to dependents on death. The terminal illness rider, if opted, will pay 25 per cent of the sum assured (with Rs 1 crore limit) on diagnosis of a listed terminal illness. The policyholder's nominees receive death benefit on death of the policyholder. The convenience of buying this policy online, does away with the hassles of going through intermediaries and one can buy the plan at convenience.

The policy also has low premium rates, as compared to other term plans of the insurer. 10,00,000 (in Multiple of Rs.This is a pure term plan which can only be bought online.

Will your loved ones be able to sustain the same lifestyle even in your absence? In order to ease some worries and give your family the best, we offer you AEGON Religare iTerm Plan, which ensures protection for your loved ones - at a fraction of the cost.ĭeath - In case of your unfortunate demise, the Sum Assured is payable to your nominee.įree Look Cancellation - In case, you are not satisfied, you may choose to cancel the policy within 15 days of receiving the policy documents. No one has control over uncertainties of life.

0 kommentar(er)

0 kommentar(er)